What is ETHENA

Still researching in progress

What is Ethena Labs?

- a defi protocol focused on creating financial instruments.

- flagship product is USDe, a unique type of stable coin

- ENA is the governance token Internet Bond concept

- USDe: The Synthetic Dollar USDe is not your typical fiat-backed stablecoin (like USDC or USDT). It’s a synthetic dollar, meaning its value is maintained through:

- Collateralization: Backed by a basket of crypto assets.

- Short Futures Positions: These positions hedge against potential fluctuations in the underlying collateral.

- Advantages of USDe:

- High Yields: Protocol design allows USDe to offer competitive yields attractive to investors.

- Decentralized: Unlike centralized stablecoins, USDe is governed by the Ethena community, enhancing transparency and user control.

- ENA: Internet Bond An innovative concept that envisions a crypto-native bond instrument yielding a steady return. The yield is derived from:

- Staked Ethereum rewards

- Funding and basis spread captured from derivatives markets.

- Aims to provide a reliable dollar-denominated savings vehicle with potentially attractive returns.

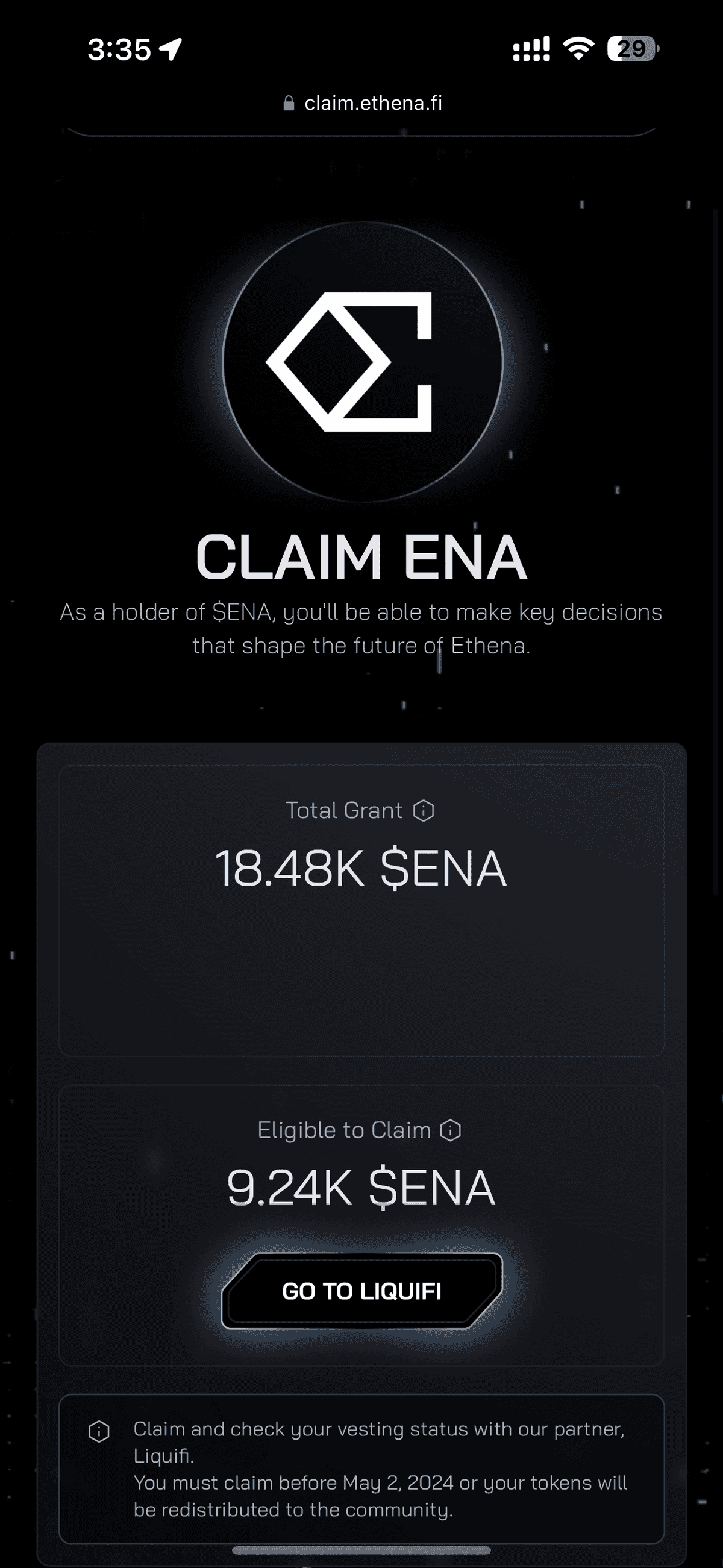

- ENA Token Ethena’s governance token. ENA holders can:

- Participate in protocol decisions

- Propose changes

- Influence the future development of Ethena Labs.

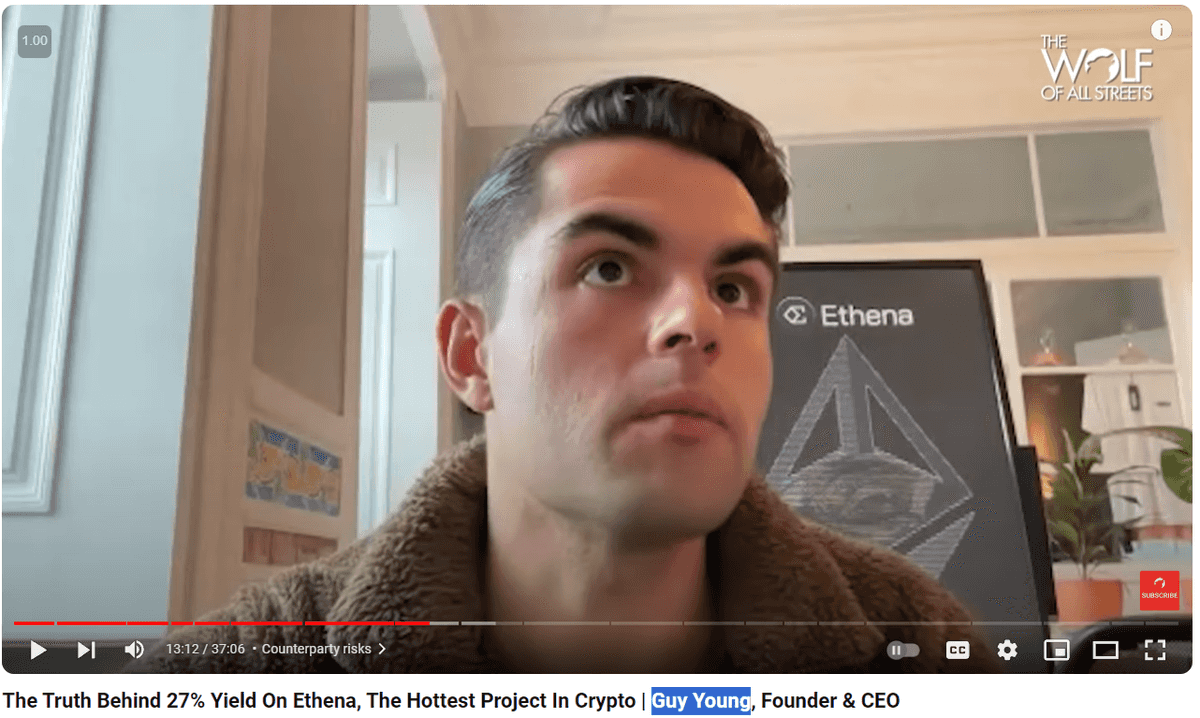

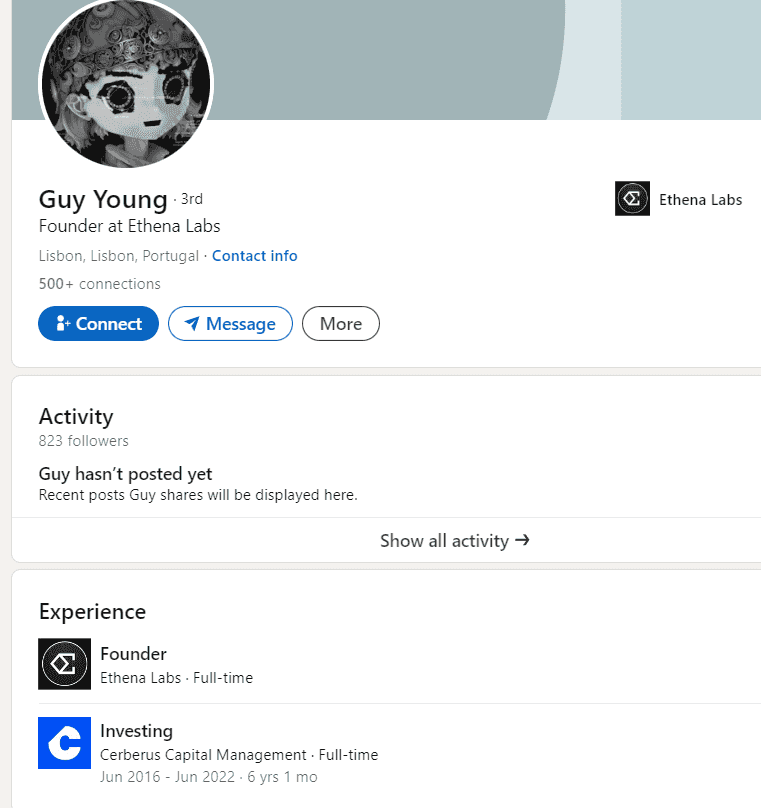

Founders

Who is Guy Young

Cerberus Capital Management: 60B AUM

How USDe Maintains Its Value

-

Sending ETH to Mint USDe: When someone wants to create (mint) USDe, they start by sending Ethereum (ETH) to a specific smart contract on the Ethereum blockchain.

-

Hedging the Delta: The moment ETH is sent, Ethena Labs uses a strategy called “delta hedging.” This means they take an opposite position in the market to neutralize2. the risk of ETH’s price fluctuation. If ETH’s price goes down, the hedge should compensate for the loss, and if ETH’s price goes up, the hedge limits the gain. This strategy is crucial for maintaining the stable value of USDe.

- Example: If you send 1 ETH worth $2,000 to mint USDe and ETH’s price drops to $1,500, the hedging strategy aims to cover the $500 loss, ensuring you have $2,000 worth of USDe.

-

1:1 Collateralization: This approach means that for every USDe minted, there is an equivalent value in ETH (plus the hedging strategy) backing it up. This is intended to ensure that USDe can always be redeemed for its equivalent value in ETH, maintaining its peg to the US dollar.

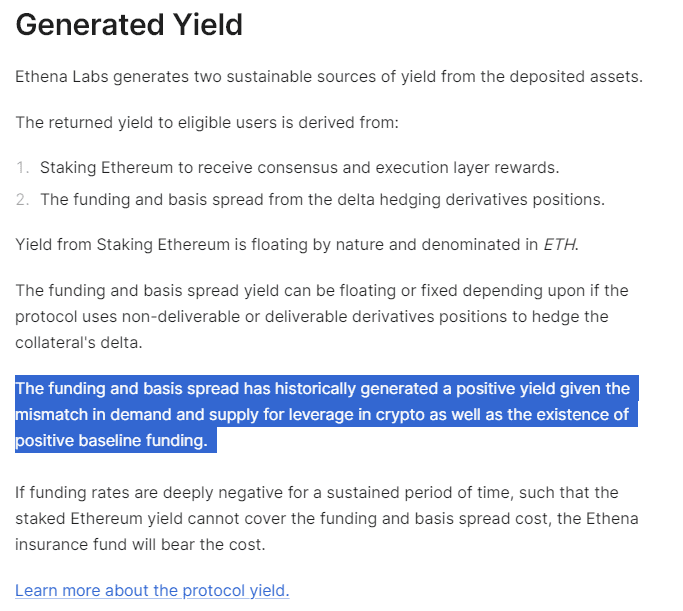

How yield is generated 27%

- Staking Ethereum to receive consensus and execution layer rewards. (3-4%)

- The funding and basis spread from the delta hedging derivatives positions.

- Not everybody that swap USDe will stake to earn, so it will be shared amongst all who staked.

Questions

- how do you generate yield of 34%? staked eth is only 4-5%. where is the other 30%?

- what is the insurance fund? is it the same as reserve fund?

- reserve fund is at 34m. where did the money come from?

- what is the value of ENA? is it pegged to anything?

- how is it minted?

- other than governance, what other purpose is there?

- the protocol’s collateral is 1.98b of ETH, ETH LSTs and USDT by the CEXs. that should be in USDe right? why is there value to ENA?

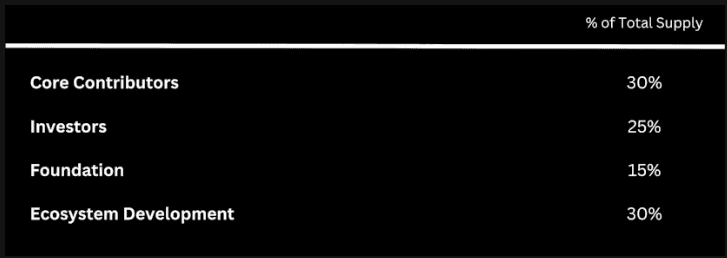

ENA Tokenomics

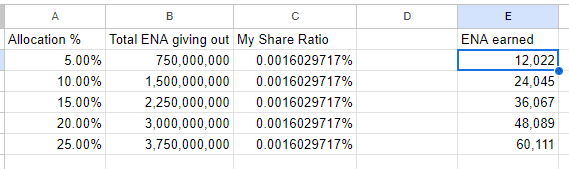

Core Contributors - 30% Investors - 25% Foundation - 15% Ecosystem Development - 30%

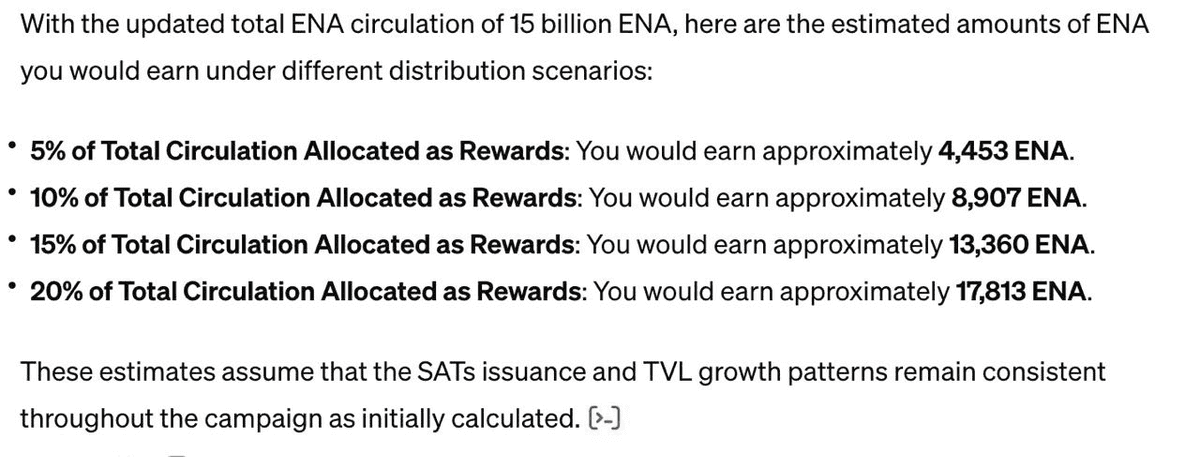

- 5% = 750m for phase 1

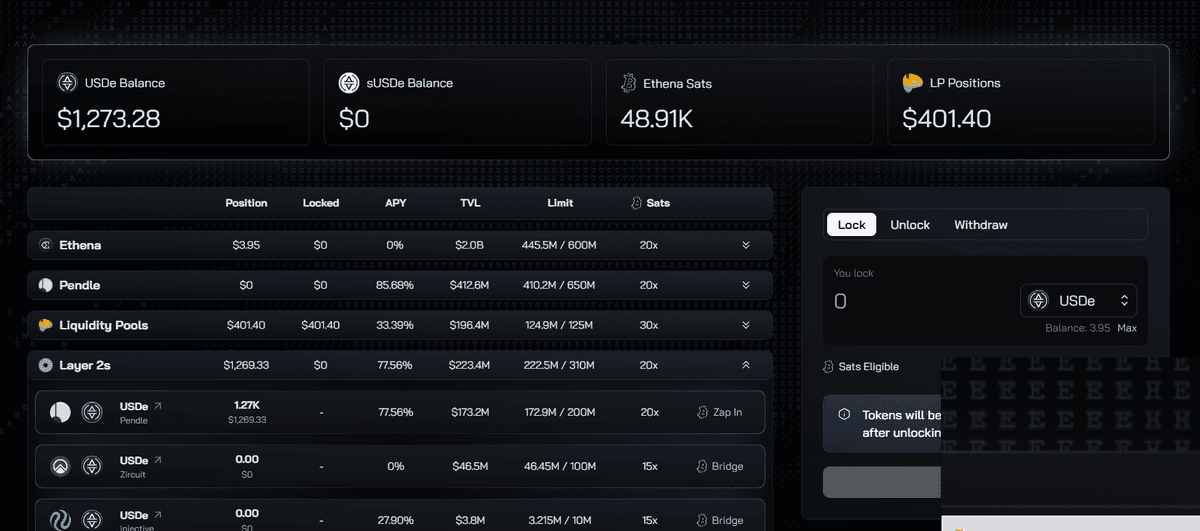

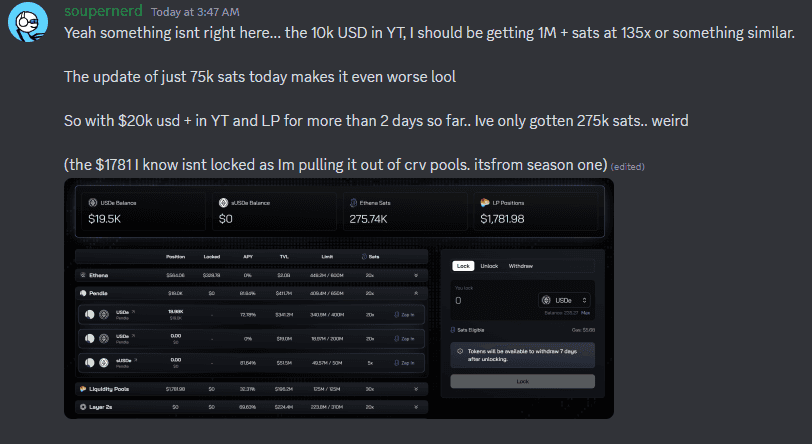

Identify if earning SATS or APY is better.

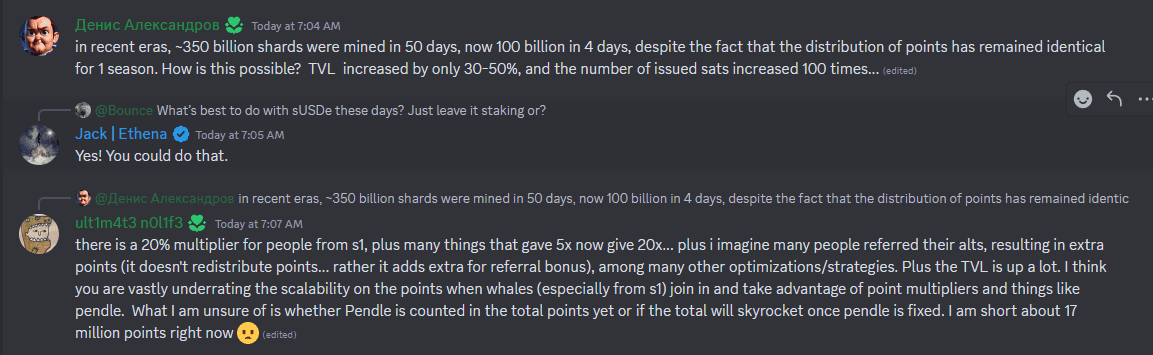

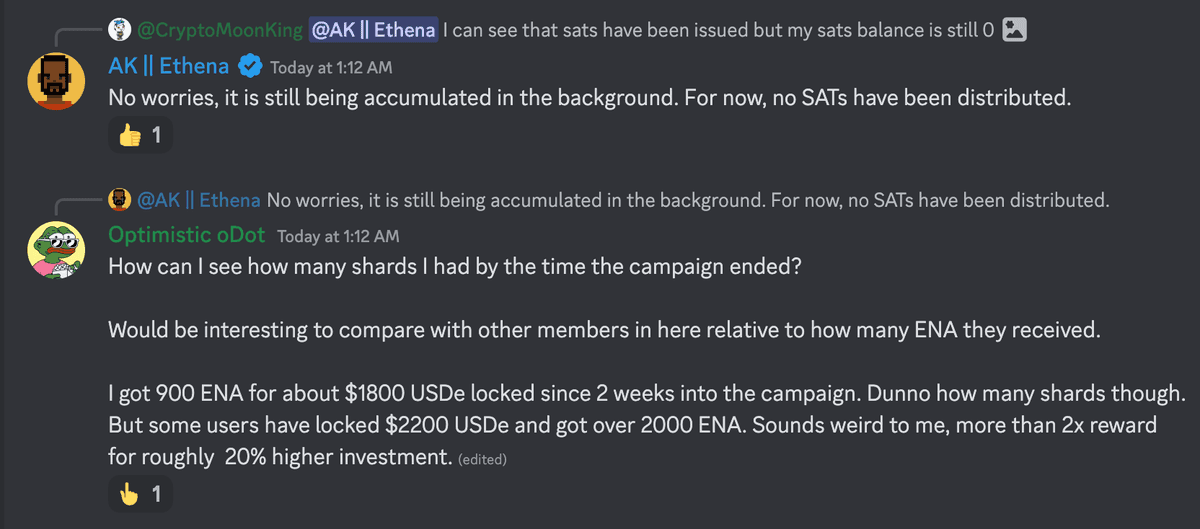

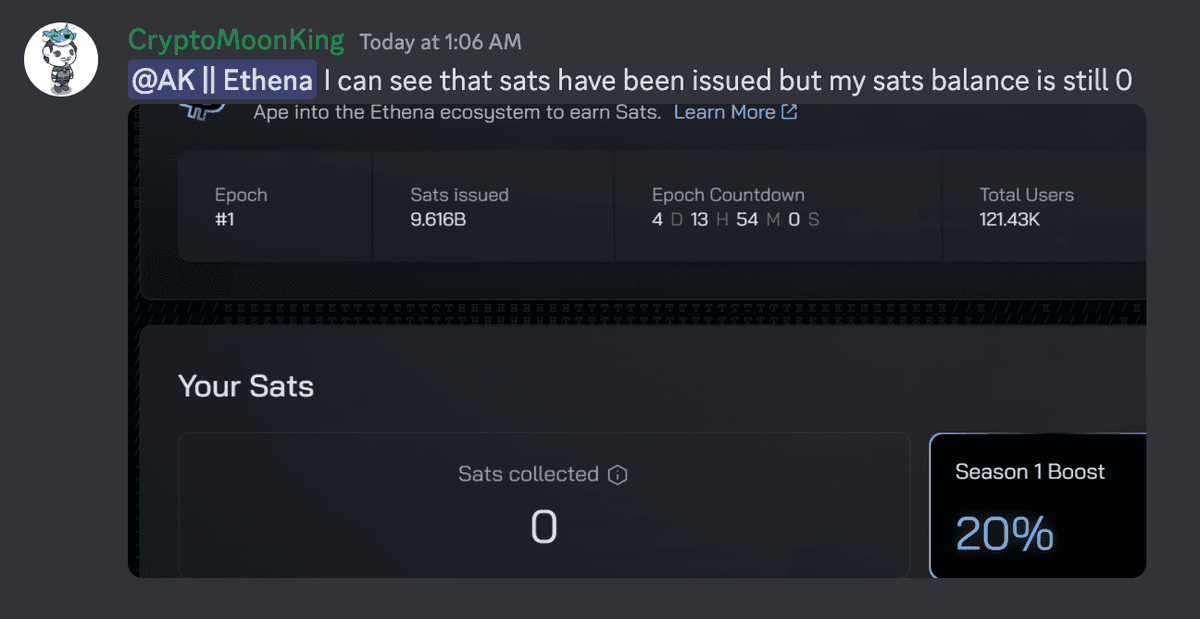

TVL 1.99B = 76.99B Sats Issued

For every 1 USDe, how much SATS will you earn? lets say 1 USDe you earn 20 sats.

total give out maximum is 25% which is 3.75b. lets say lowest given out is 5% which is 750m.

phase 2 is until 2 sep. or hit 5b.

Earnings Forecasting

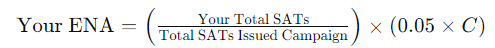

1. Step 1: Calculate Your Total SATs Earned

Total SATS = Your USDe * RETURN RATE * DAYS HOLDING

my usde = 40k usd. return rate = 20x days holding = days of campaign = 153

Total SATS EARNED = 122,400,000

Step 2: Estimate total SATS issued by the Campaign Linearly

assumption: if TVL grows at 0.02B per day, it takes 151 days to reach 5B. at an average of 14x SATS issued daily, the total SATS issued would be: TOTATL SATS ISSUED: 7,497,000,000,000

Why 14x? on day 4, 5 apr, SATS issued was 28.01B. vs TVL of 2.01b. thus 13.93 rounding up to 14. Total Circulating Supply: 15b

Step 3: My share in of ENA

[122,400,000 / 7,497,000,000,000 ] *

At different rewards allocation.

Which is the best way to earn SATS?

If Farm SATS only

Stalking Homework

Sources:

- Tokenonmics of ENA

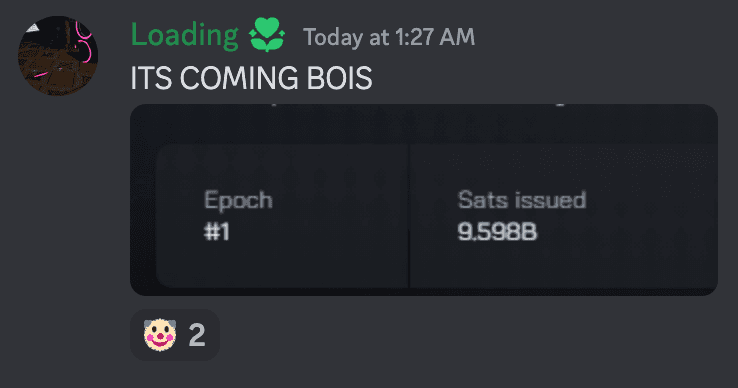

- Ethena Shard Campaign: Epoch 1

- ENA Airdrop and Season 2: Sats Campaign

- Ethena Labs Overview Gitbook

- FAQ Notion Site

- Founder Guy Young Podcast Video

- An honest review of Ethena